A

A

Humans have been trying to develop fully autonomous vehicles (AVs) for decades. Now, at the turn of the new decade, we are just starting to see them picking up traction beyond just testing.

This summer, the Tokyo Olympics have twenty driverless buses, developed by Toyota, to shuttle athletes around the Olympic village. In October 2020, Waymo launched a driverless fleet of over 300 vehicles which move people around Phoenix, Arizona.

Transportation stakeholders and mobility startups are putting in tremendous efforts to be the front runners in this AV revolution. Established giants like Uber, Tesla, and Audi are investing billions of dollars in AV alongside other new companies on the market who are equally collecting billions in funding from investors.

As it picks up traction, claiming a larger stake in the mobility industry, autonomous mobility will continue to send out a widening ripple effect across society, policy, and the market.

AVs will shake up urban mobility across the board.

For commuters, AVs will shift our relationship with vehicles from private ownership and use to consuming it as a service (MaaS – mobility as a service). This will shift mobility services to becoming a commodity.

In China, AVs could make up 66% of passenger kilometers traveled in 2040 according to McKinsey.

Source: McKinsey Report

Autonomous mobility could lead to more vehicles on the roads and more congestion if cities do not react with the right policies. But, if AVs are regulated and optmised well, it could also enable fewer, better utilised vehicles on our roads, reducing congestion and making better use of urban spaces.

Additionally, vehicle life cycles will change. If vehicles are fully optimised and in use at all times, they will wear down faster than a vehicle that is privately owned and only driven less than two hours every day, on average. The mix of car purchasers will change from private owners to commercial fleet operators, leading to the automotive industry further innovating their business models along the way.

Robotaxis unlock a massive transformation for fleet management.

All this will aggregate to a massive shake-up of ride-hailing and taxi services as we know them. It will unlock a new era of fleet management that is cheaper and maybe easier, but definitely different. It will open the doors for new non-traditional mobility players to compete in the transportation market.

A Nissan survey projects that over the next twenty years, 55% of small businesses will have robotaxis.

Source: Nissan Motors Corporation Report

In the last decade, we saw a disruption to the taxi industry with the conception of ride-hailing, which brought a new breed of market players, like Uber, Lyft, or Didi. But what defined this revolution and how were these Uber-likes able to gain traction so quickly?

Unpacking the last ride-hail revolution.

One reason was their non-adherence to existing taxi legislations, particularly the number of vehicles that can operate in a city or licensing that taxi drivers need to adhere to. This allowed Uber-like operators to tap into a larger pool of drivers to put behind the wheel. Better yet, they actually tap into the pool of drivers with their own vehicles, filling two needs with one deed.

Such a no-large-capital-required strategy has soon given them the largest pool of cars in the city. Coupled with the mobile app usage boom, they are also not tied up with the baggage of call centre operations.

So it boils down to three factors that enabled Uber-likes to build new global marketplaces from scratch:

- Supply: large capacity of vehicles and drivers not bridled by regulations

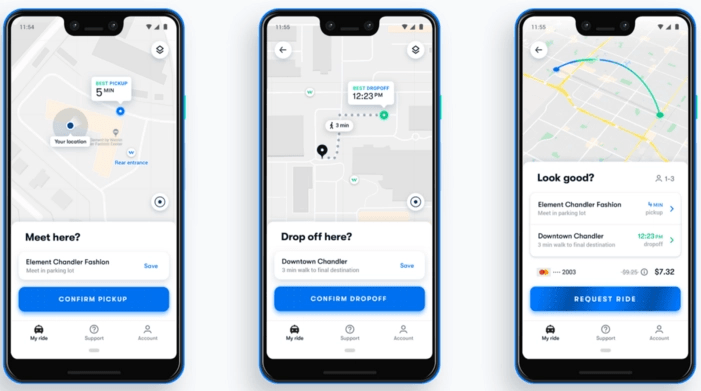

- 10 X consumer market proposition: fast and easy ordering process

- Ability to scale: venture capital to fuel growth with incentives to raise volumes of both drivers and passengers

Driverless fleets — more efficient to run.

So far the industry has shifted from fully human to half-digitised operations.

What has been digitised to date are ordering and dispatching operation systems. Uber-like operators have gone fully digital on the ordering part and aren’t likely to go backwards to call centres ever. And existing taxi businesses with call centres taking phone orders have just a matter of time before they will automate with AI conversational technology.

What has not been automated is the vehicle driver, and until we are operating with robotaxis, we need human drivers. When we look at history and other industries, we see the benefits of digitisation and automation, and the same tenants will hold true to the taxi industry.

Firstly, it significantly saves operational costs. Today, human drivers account for about 60% of the taxi ride cost.

Secondly, digitisation and automation give more manoeuvrability to scale up. A ride-hailing operator needs to acquire two resources to build a supply: vehicles and drivers. And acquiring a human driver is the biggest obstacle for fast scalability and global operations.

And thirdly, robots are more predictable and efficient to run. Today’s ride-hailing operator needs to take into consideration the quite unpredictable and non deterministic behavior of such a human driver. Even when you know where your vehicles should be operating and what rides should be fulfilled, your business will never be as efficient and optimal as your allocation systems may calculate for you.

Robotaxis will further make a near-perfect world for taxi businesses because it will solve two additional inefficiencies: supply scarcity and disobedience.

With AVs leveling market entry, who could be the next Uber?

So how could history repeat itself? Could Uber be de-throned similarly to how Uber won over the taxi industry?

A new marketplace leader would need to be “better” in Uber’s own game:

- Bigger supply and faster supply ramp-up

- Better consumer market proposition — 10 X product (or cheaper pricing?)

- Faster consumer acquisition and scaling

In a world of AV manufacturing churning out vehicles for buyers to grab, a capability of acquiring human drivers that Uber has so painfully learned throughout the last several years will become obsolete. AVs will level the field for newcomers to ramp-up capacity on par with Uber’s then existing fleet. Unless these Uber-likes step up to fully AV fleets, they will be over-weighed with the extra responsibilities of human drivers and under-optimised fleets.

With this full digitisation, AVs themselves will be a 10 X product, regardless of which industry they are deployed to. And the final cherry on top of it all; lower insurance premiums and cheaper maintenance brings reduced operating costs, which allow for cheaper and more competitive service pricing.

As soon as autonomous vehicles arrive, the cost will fall to an equivalent of 10–17 eurocents per kilometer

Source: Interview with Juraj Atlas about autonomous vehicles

Newcomers to the transportation industry would need to primarily focus on demand acquisition. But wait, what if such a newcomer already has a user base which might even be larger than what Uber has succeeded to build by then?

Economies of scale and massive user bases: the advantages big tech businesses will have.

Fully digital and big tech businesses, regardless of their presence within the transportation industry, have the potential to outperform existing ride-hail operators due to their wider user base and user data resources. Currently, a company that solely provides ride-hail services only has access to data from that source. But big tech companies may have a broader scope of data resources to better understand market demands. Plus, having an economy of scale to better leverage their market entry and proposition.

More expansive and sophisticated big tech companies will be able to better model and optimise their service deployment. For example, it will be effective to send robotaxis to underserved scarce-demand areas, which is a current challenge because it is difficult to incentivise human drivers to do so.

Already, we’re seeing non-traditional transportation players starting to enter the ride-hail scene with fully autonomous vehicles and are ready to compete with Uber.

- Alibaba financed AutoX in 2020 and collaborated with Alibaba’s Amap in 2021 to help them become the first robotaxi service available on a national scale in China.

- Amazon bought Zoox in 2020, which is being tested on private and public roads as they move towards launching their own ride-hailing service.

- Apple has been heard of working on autonomous technology for robotaxis, though results were not yet seen.

- Google started the moonshot project of autonomous driving technology way before the first Uber investors pitch deck was drafted, in 2009. This project led to a Waymo spin-off in 2015. Google Maps started by an acquisition in 2004. So Google is hardly a newcomer to the mobility industry.

Could Facebook become the next Uber?

From here, what could be stopping other non-traditional big tech giants from the mobility market at the right time? Can we expect Facebook to enter the mobility business? With this AVs-enabled framework, it might not be such a far-fetched idea. What do you think?

Reach out to me on LinkedIn, I’m curious to hear your thoughts on this topic.

.

For more blog posts and urban mobility updates, follow Mileus on LinkedIn: