R

R

Ride demand is back up, but there aren’t enough drivers.

The repercussions of the COVID-19 pandemic continue to send ripple effects across the urban mobility landscape as mobility providers react, recover, and adapt to changes. Ride-hail and taxi customers feel these repercussions actualise in more expensive rides and longer waiting times. Naturally, this turns customers away, further hampering ride frequencies at large for operators.

- Blackpool Council’s licensing service reported that the two biggest operators in the town were reporting evening driver resources were 50% down from pre-pandemic levels

- North West Taxi Proprietors reported they lost about 30% of drivers during COVID

- Glasgow Taxis told BBC Scotland it had lost a third of its drivers during COVID

- Aberdeen Taxis, claims the city has lost 60% of its drivers during the pandemic

At the start of the pandemic in 2020, drivers were not getting enough business as customer demand dropped in wake of lockdowns and travel restrictions. Today, the market has flipped with more demand than there is supply.

In wake of the pandemic, drivers reacted to the sudden drop in ride requests by switching to other means of work, particularly in on-demand delivery services, a sector which saw a sudden growth.

On a basic supply and demand premise, one would think the market would naturally react and rebalance itself. However, drivers are not going back despite the demand — the market structure has shifted.

As we get through the pandemic, passenger ride demand continues to pick up. As we enter Q4 — the busiest season for operators — drivers still aren’t moving back.

“As restrictions have been lifted, starting in April, the amount of journeys has returned in abundance, with people going about their daily lives once again. However, the balance of available work to available drivers is currently in dire need of more drivers,” says James Bradley, the Director of Alpha Taxis in Liverpool.

How is this problematic for ride-hail and taxi operators?

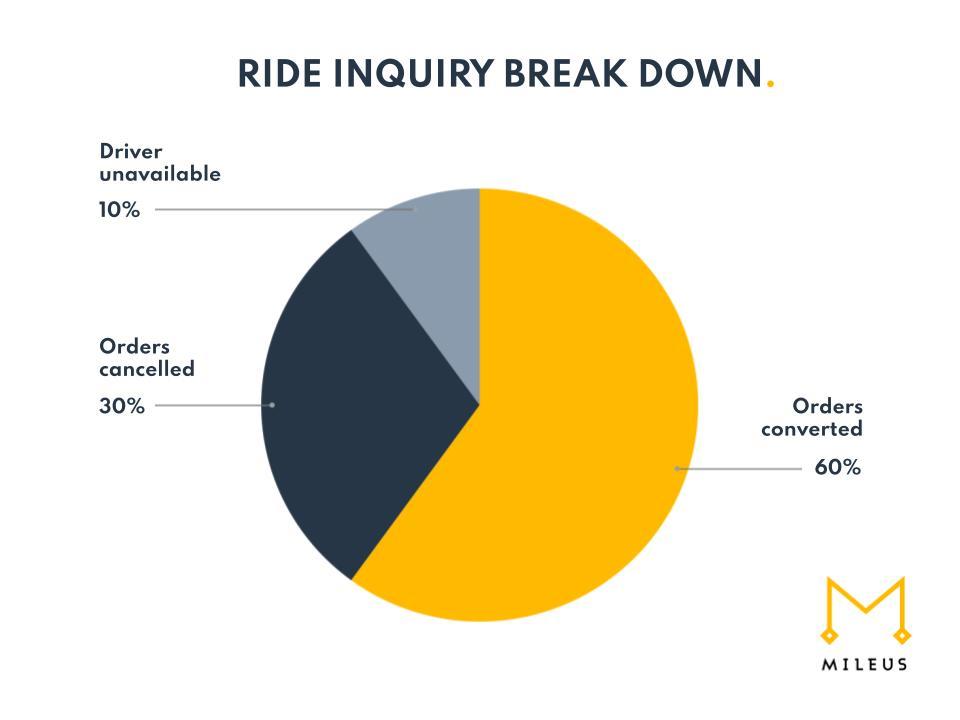

Before the pandemic, around 80% of passenger orders would end up in a ride. But today, that number has dropped about 20% as operators are stuck with fewer drivers on the road.

Higher ride prices, increased wait times, and driver unavailability decreases operators ability to convert orders into rides.

This 40% gap of non-converting orders that exists today can be broken down to 10% driver unavailability and 30% non-converting orders or cancellations due to the customer’s dissatisfaction with the higher price or wait time.

For operators, this jointly results in lost revenue and pushes customers away to direct competitors or another mode of transportation.

But how can operators lean into this pain point and make it into an opportunity to grow the standing 60% order conversion rate?

Intermodality: a solution to grow rapidly, yet sustainably.

Intermodality allows ride-hail and taxi operators to integrate public transportation into passengers’ commutes, tackling driver unavailability, increased prices, and long wait times.

It does so by incorporating public transportation into ride-hail and taxi services in a way that is optimised for drivers and operators.

Intermodality targets just the 40% non-conversion gap without interfering with the 60% of converting rides. How? The passenger is only provided an intermodal offer if there’s no driver available or they cancel their search.

It simply adds extra opportunity to the operator’s existing business.

For the operator, this boosts ride frequency, enables better fleet utilisation, and cuts back deadheading kilometres (routes with no passengers).

For the passenger, it ultimately helps make them stick to your service by helping ensure there is a driver available, providing a cheaper option if the first offer was too expensive, and decreasing the pick-up time.

Intermodality unlocks improved service availability and conversion rates in three key ways.

1. Using waiting time to get somewhere.

Normally, drivers are willing to wait 10-15 minutes to pick up a passenger, particularly if the pickup up point is near and they don’t incur many deadheading kilometres.

If the closest driver is 15 minutes away, that represents about a 5-7 kilometres distance. With the standard model, the passenger waits in one place for the whole 15 minutes as the driver moves closer to them.

Or, with intermodality, the commuter can use public transportation to get closer to the driver, effectively cutting down their wait time.

If the city centre is congested with traffic during peak commute hours, as is often the case in many metropolises, public transportation for the most part can move faster in these areas. Once again, this helps them get to where they need to be sooner by effectively leveraging the best of backbone public transportation infrastructures with the comfort of a private hire vehicle on the last leg of their journey.

2. Lower ride cost, higher ride frequency.

It’s basic economics 101: lower service price results in higher customer use frequency and wider market engagement. Intermodality does this in two steps.

A customer is more likely to decline a ride if they open their app to see the cost is 40% more than what they’re used to, in addition to extended pickup times.

But, if the service operator is able to turn that around and offer cheaper rides, passengers are more likely to tap confirm.

Furthermore, operators can tap into a new market segment of more price-sensitive passengers who would have otherwise considered a full taxi commute too expensive.

By integrating public transportation into passengers’ journeys, operators jointly increase ride frequency with existing users and widen market reach.

3. Next level flexible order stacking.

There are two key factors which determine a driver’s ability to accept their next ride:

- Location: the driver is within a reasonable distance of the requested pickup

- Time: the driver is close to completing their current journey

Say the average ride-hail or taxi journey is ten minutes; the driver can only consider picking up the next passenger during the last few minutes of that journey. This ensures the next passenger doesn’t wait too long and the driver minimises deadheading kilometres.

By unlocking more pickup points, intermodality provides more flexible driver-passenger matching. If a customer is moving towards the driver, any of the public transportation stops on their way can be taxi pickup points. This gives dispatching algorithms a higher matching probability, so drivers can stack orders with more flexibility.

It’s simple; more flexible drive-passenger matching opens up higher service availability.

How does intermodality boost conversions in numbers?

Considering that an intermodal ride is available for 75% of searches and 25% of customers accept the ride offer (both of which are modest numbers—it’s likely they will be much higher), the numbers speak for themselves.

The calculations show a 13% ride-conversion rate increase, propelled by lower AOV and increased ride frequency. This translates to 7% revenue boost.

If you’re interested to see how intermodality could be applied to your ride-hail or taxi business to help grow your business in a rapid, yet sustainable way, I’d be happy to explore this with you. You can contact me at juraj@mileus.com.

.

Want our regular urban mobility news, updates, and insights? Follow Mileus on LinkedIn!